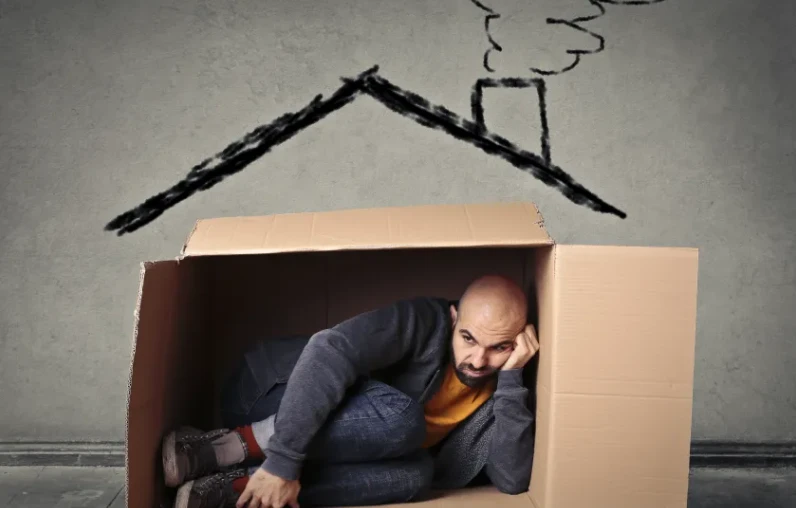

Real estate experts use the term “House Poor”, or “Poor House”. to describe a particularity of the owners that does not necessarily have to do with their wealth

Although “House Poor” translates as “Poor House”, and an image immediately comes to mind, it has nothing to do with the composition of the house or even with the family that inhabits it. It is actually a term used in the real estate market to describe buyers who have bought a property that they cannot afford easily and find themselves in serious financial and personal trouble.

Although it does not mean that the house or the family within this difficulty is necessarily poor, a “House poor” is that borrower who finds it difficult to pay their mortgage and who, therefore, must make extraordinary financial sacrifices, such as limiting their meals or other necessities to make ends meet.

“If you can’t spend your income the way you want because so much of it goes to housing expenses, you have a ‘poor house,’” explains Debra Neiman, a financial planner with Neiman & Associates Financial Services in Arlington, MA, to Realtor.

According to the 2017 State of the Nation’s Housing Report from the Joint Center for Housing Studies at Harvard University, nearly 40 million households are housing poor in the US.

The vast majority of real estate and financial experts advise that you should pay no more than 30% of your income on housing expenses. What not many understand is that “housing expenses” include not only the mortgage, but all the underlying expenses that come from being an owner, such as paying property taxes, the cost of services, among others.

For example, if you earn $5,000 a month, your housing expenses should not exceed $1,500, between the mortgage and those already mentioned.

How to determine how much house you can afford?

So that you do not live in a “poor house”, no matter how luxurious it may be, you must know how much housing you can afford.

One of the most common formulas, but not unique, is your debt-to-income ratio, or known by many as DTI, for its acronym in English. The lower your DTI, the higher the amount you can pay. Fannie Mae suggests that your total debts, including your proposed mortgage payment, make up no more than 36% of your payment, even though you may qualify with a debt-to-income ratio of up to 50% in some cases. Neiman suggests keeping it below 30%.

“If you buy at the top of your price range, you could risk becoming a house poor,” she says.

To complete the equation, mortgage lenders also look at what your down payment is and what your credit score is to determine whether or not you’ll pay off your home mortgage.

If you do not know how to make this calculation, you can approach the various calculators that exist on the Internet, to find out how much you can pay for the home you want.

But beyond the parameters that these calculators take into account to find out how much house you can afford to pay, you yourself must make an analysis of your expenses: won’t paying a mortgage prevent you from meeting your basic needs? Do you have high credit card debt? Despite your mortgage, can you save an emergency fund, for your retirement or for your children’s education?

There are aspects that only you know about your financial capacity and that not any calculator will be able to distinguish to know if you can afford or not to pay this or that house.