Asian stocks were mixed and the US dollar hit a one-month high as the threat of recession loomed over Europe and highlighted the relative outperformance of the US economy.

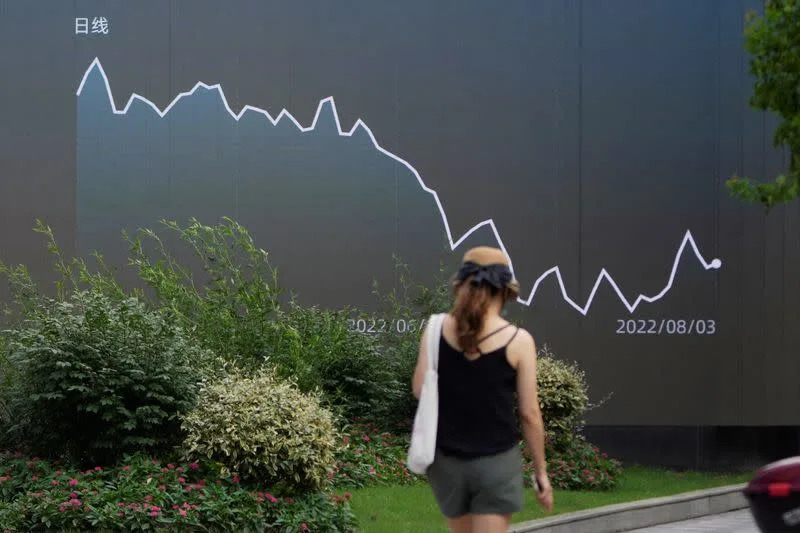

Added concern over the health of the Chinese economy caused the broader MSCI index of Asia-Pacific stocks, which excludes Japan, to drop 0.1%, down 1% from a week earlier, and the yuan headed for its worst week since May.

The yuan broke through the psychological barrier of 6.8 per dollar and was approaching a two-year low. [CNY/]

Stimulus hopes kept Chinese equities unchanged, while South Korea lost 0.4%. The Japanese Nikkei was stable, helped in part by a further decline in the yen.

S&P 500 futures were down 0.2% and little changed on the week, after repeatedly failing to break above the 200-day moving average, while Nasdaq futures were down 0.2%.

EUROSTOXX 50 futures were down 0.2%, while FTSE futures were up 0.2%.

The threat of rising borrowing costs loomed over markets as no fewer than four US Federal Reserve officials signaled that interest rates needed to be raised further, despite disagreeing on the speed and level.

Markets are leaning towards a half point hike in September, but see a growing risk of a 75 basis point (bp) hike, currently a 2/5 chance. Rates are seen to peak at 3.5%, although some Fed members advocate 4% or higher.

“There are no signs that the labor market or inflation data is slowing enough for the Fed to declare victory over inflation,” said Brian Martin, head of G3 economics at ANZ.

“We see upside risks to the Fed’s inflation projections and expect them and the dot plot to be revised higher in September,” he added. “We have revised up our year-end Fed rate forecast by 25 basis points to 4.0% and now expect three 50 basis point hikes in the remainder of 2022.”

All of this underscores the importance of Fed Chairman Jerome Powell’s August 26 Jackson Hole speech, which is often a seminal event on the central bank calendar.

The bond market is clearly on the aggressive side, with two-year yields 33 basis points below 10-year yields and recession warnings.

DOLLAR IN DEMAND

The “R” alarm for recession is also sounding in Europe and Asia. Chinese economic indicators have been dismal this week with only hopes of regulatory relief and government aid keeping tech and real estate stocks priced. [.HK]

China issued a drought alert on Friday.

After half a year of war in eastern Europe, natural gas prices hit a closing record on Thursday, adding to an inflation pulse that is sure to fuel a more painful policy tightening, exacerbating recession risk.

The gloomy economic outlook has seen the euro fall 1.7% so far this week to $1.0070 and back to its July low of $0.9950.

The dollar has also risen 2.0% against the yen this week, reaching 136.38, the highest level since the end of July. Against a basket of currencies, it was up 1.9% on the week at 107.66.

Sterling was another casualty, losing 1.8% on the week to $1.1917. Investors fear that British inflation, located at a stratospheric 10.1%, will lead the Bank of England to continue raising interest rates and cause a recession.

The cost of living crisis caused British consumer confidence to fall to its lowest level in August, according to a monthly survey by data provider Gfk.

“Strong wage and price data has raised the bar for inaction and we now think the BoE will need to see clearer signs of a hard landing to pause,” said JPMorgan analysts, who raised their rate forecasts. at 75 basis points, at 3%.

“We expect a two-quarter recession starting in the fourth quarter that translates into a cumulative drop of 0.8% in GDP.”

The rise in the dollar has been a headwind for gold, which is down 2.4% so far this week at $1,758 an ounce. [GOAL/]

Oil prices were a bit more stable on Friday but continued to slide for the week, with Brent hitting its lowest level since February at one point on demand concerns. [OR]

Brent crude fell 45 cents to $96.18, while US crude fell 38 cents to $90.12 a barrel.