NEW YORK – The deadline for filing tax returns is approaching, April 18. However, taxpayers who cannot declare them before that day can request more time by filling out a form which will give them until October 16 to submit them.

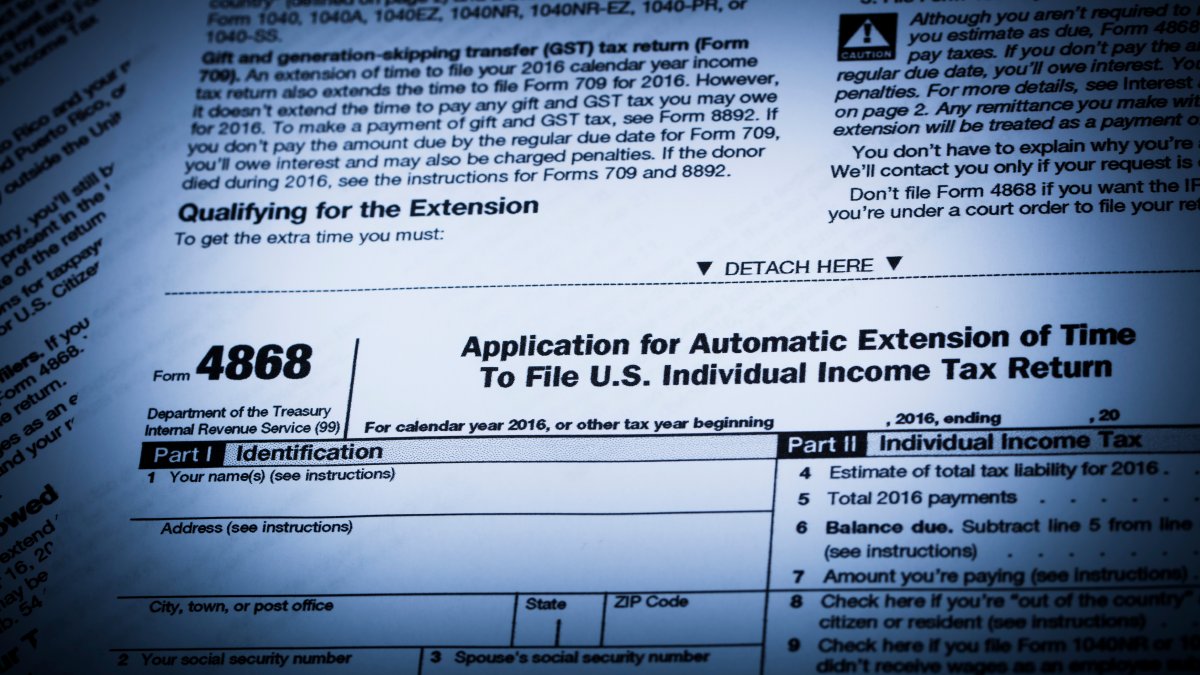

Any taxpayer can request an extension, this is automatic and free, via Form 4868, which contains 9 questions and is available on the IRS website. This can be sent using the section Free file here.

Just fill out the form, but be aware that a file extension is not an extension for paying taxes. If they owe taxes, they should pay them before the due date to avoid possible penalties and interest on the amount owed.

“There are two types of penalties, the non-payment penalty and the non-declaration penalty,” said IRA spokesperson Alejandra Castro. “The penalty for non-declaration is much, much higher than for non-payment, the penalty for non-declaration is 5% per month up to a maximum of 25% of the debt amount,” he said. -he adds.

So when you file the extension, you must include payment of what you think is your tax liability. The additional 6 months are only used to obtain the documents necessary to present the declaration. when this is taxpayers are requesting the extension to file their 2022 federal income tax return until October 16, 2023.

“The most important thing is that the taxpayer shows up on time, sends a check with as much as he can, because the problem is if he doesn’t show up, he’ll get a double penalty,” Castro said.

If you send the wrong amount and owe more tax, the IRS will charge you interest on the unpaid tax.

How to request a free extension to file a return if you don’t owe taxes

Individual taxpayers, regardless of income, can use IRS Free File at IRS.gov/freefile to request an automatic six-month extension to file their taxes. Alternatively, taxpayers can file Form 4868, Application for Automatic Extension of Time to File United States Personal Income Tax Return.

What should I consider

- An extension of time to file your return does not give you an extension of time to pay your taxes.

- You must estimate and pay any tax due by its regular due date to avoid possible penalties.

- You must file your extension request by the usual due date for filing your return.

More information

For more information, go here.