SNAP Benefits 2024: Increased Allowances and Adjustments Explained

Each year, as with Social Security benefits, an adjustment is made, based on inflation and the nation’s cost of living. And calculations have already been made to determine when benefits will be delivered by 2024.

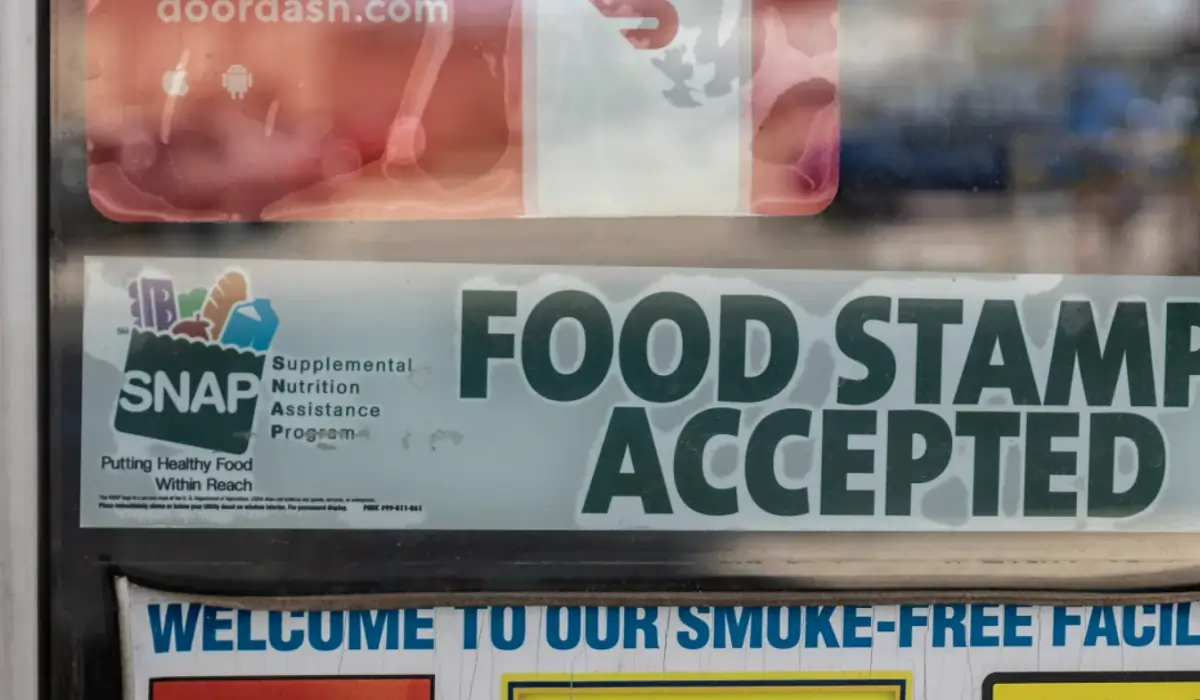

The United States Department of Agriculture (USDA) is the lead organization in providing SNAP (Supplemental Nutrition Assistance Program) vouchers to low-income families. Each year, as with Social Security benefits, an adjustment is made, based on inflation and the cost of living in the country. Calculations have already been made to determine when benefits will be delivered by 2024.

Recently, SNAP revealed the amounts that U.S. households will receive for fiscal year 2024, which will be reflected for collection beginning in October 2023. The new provisions indicate that a family of four can receive a maximum of $973 per month, currently $939 is given.

This means that the maximum payments for 2024 are increasing by 3.5% to 3.7% over the 2023 allowances.

“Maximum allotments will increase for the 48 states and DC, Alaska, Guam, and the U.S. Virgin Islands. The maximum allotment for a family of four in the 48 states and DC will be $973. The maximum allowances for a family of four will range from $1,248 to $1,937 in Alaska. The maximum allowance for a family of four will be $1,434 in Guam and $1,251 in the U.S. Virgin Islands. Maximum allowances for a family of four in Hawaii will decrease to $1,759. The minimum benefit for the 48 states and DC will remain the same at $23,” a text posted on the USDA website explains.

It also explains that the refuge limit value will increase to $672 for the 48 states and DC. The shelter-in-place threshold values for Alaska, Guam, Hawaii and the U.S. Virgin Islands will also increase. The maximum homeless shelter deduction will increase to $179.66 for the 48 states and DC, Alaska, Guam, Hawaii and the U.S. Virgin Islands. The minimum standard deduction for household sizes 1-3 increased to $198 per month for the 48 states and DC Alaska, Guam, Hawaii and the U.S. Virgin Islands also saw increases in their standard deduction amounts.

“Regional offices should make sure their states are aware of these changes. State agencies that have questions about these adjustments should contact their respective regional office representatives,” he added.