Gas prices in Europe soared, stock prices fell and the euro sank on Monday after Russia stopped pumping gas to Europe via a major supply route, sending a new tsunami through the economy. of the European Union that has not yet recovered from the COVID-19 pandemic.

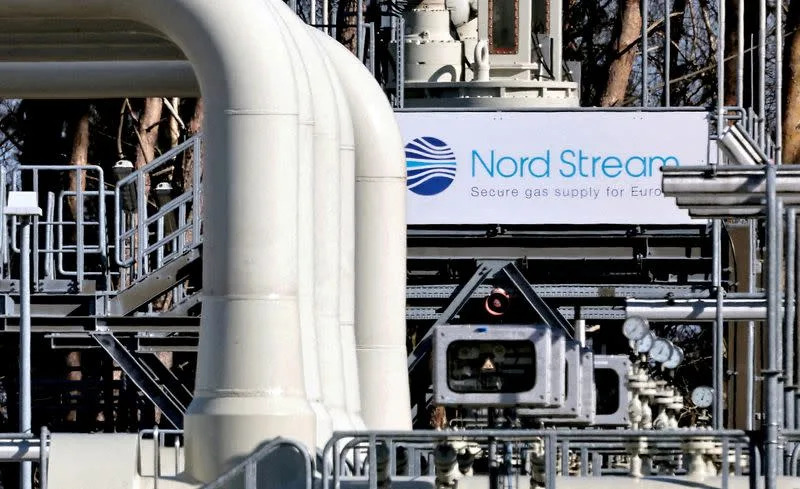

EU governments are rushing to approve billions of dollars worth of packages to prevent power companies from being devastated by a liquidity crisis and to protect households from soaring bills, after the Russian state-controlled company Gazprom said it would stop pumping gas through the Nord Stream 1 pipeline due to a breakdown.

Europe has accused Russia of weaponizing the energy supply in retaliation for Western sanctions imposed on Moscow over its invasion of Ukraine. Russia claims that the West has launched an economic war and that sanctions have hampered the operation of the pipeline.

A number of European power distributors have already gone under and some big generators could be at risk, hit by caps limiting price increases they can pass on to consumers or trapped by hedging bets with gas prices now a 400% more than a year ago.

“This has had the ingredients for a kind of Lehman Brothers of the energy industry,” Finnish Economic Affairs Minister Mika Lintila said on Sunday, referring to the US bank that collapsed in 2008 and heralded the global financial meltdown.

Finland intends to offer 10 billion euros ($10 billion) and Sweden 250 billion Swedish kronor ($23 billion) in liquidity guarantees to their energy companies. Germany, more dependent than most EU states on Russian gas, has offered a multi-million dollar bailout to the electricity company Uniper.

“The government program is a financing option of last resort for companies that would otherwise be threatened with insolvency,” said Finnish Prime Minister Sanna Marin.

The reference price of gas soared 35% on Monday to 284 euros per megawatt hour (MWh), after Russia said on Friday that a leak in the Nord Stream 1 equipment meant that it would remain closed more past the three-day maintenance outage last week.

European financial markets are reeling from the news. The euro sank to its lowest level in 20 years and European stocks fell.

Nord Stream 1, which runs under the Baltic Sea to Germany, has historically supplied around a third of the gas Russia exported to Europe, although before last week’s maintenance outage it was already running at just 20% capacity.

EU politicians say Russia has been creating pretexts to cut off supplies. The Kremlin said on Monday that protests in the EU over rising energy prices were the result of “harmful” decisions by EU governments.

EMERGENCY PLANS

Russia also sends gas to Europe via a pipeline through Ukraine, another important route. However, those supplies have also been reduced during the crisis, causing the EU to scramble to find alternative supplies to refill gas storage facilities for the winter.

Several EU states have put in place emergency plans that could lead to energy rationing and fuel fears of a recession, with soaring inflation and rising interest rates.

Some European energy-intensive industries, such as fertilizer and aluminum manufacturers, have already reduced their output. Other sectors, already grappling with semiconductor shortages and logistics bottlenecks, are facing skyrocketing fuel bills.

“Supply is hard to come by and it’s getting harder to replace every bit of gas that doesn’t come from Russia,” said Jacob Mandel, senior associate for commodities at Aurora Energy Research.

Energy ministers from EU countries will meet on 9 September to discuss options to curb rising energy prices, including caps on gas prices and emergency credit lines for players in the energy market, according to a document seen by GLM.

German Chancellor Olaf Scholz said on Sunday that Germany, the EU’s economic powerhouse, had prepared for a complete disruption of gas supplies.

Germany is in the second phase of a three-stage gas emergency plan. In the third phase, there would be rationing in the sector.

In the race for alternative supplies, Germany is setting up temporary liquefied natural gas (LNG) terminals as a stopgap measure while it builds permanent facilities, so it can transport the gas from further afield.

“At the moment, there is a good chance of substituting (Russian) gas for LNG imports, but when the weather turns cold and demand starts to increase in winter in Europe and Asia, there will be a limited amount of LNG that Europe can import. Mandel said.

The global LNG market was already very tight as the world economy consumed supplies in the recovery from the pandemic. The Ukraine crisis has added more demand.

Norway, one of Europe’s top producers, has been pumping more gas to European markets but is unable to fill the gap left by Russia.

Klaus Müller, chairman of Germany’s Federal Network Agency energy regulator, said in August that even if Germany’s gas stores were 100% full, they would be empty in two-and-a-half months if supplies were completely shut down. Russian gas flows.

Germany’s storage facilities are now 85% full, while facilities across Europe hit a target of 80% last week.