Through the ‘Get my payment’ app, the IRS allows you to check the status of your stimulus check. Here we explain what to do to claim the payment.

On March 12, the Government of the American Union approved the ‘American Rescue Plan’, an economic rescue of 1.9 billion dollars with relief for the coronavirus . Through it, about 160 million Americans were eligible for a third round of stimulus checks.

According to the most recent report from the Internal Revenue Service (IRS) so far – April 15 – 159 million Americans have received the payment corresponding to the third check, which is equivalent to 372 billion dollars in help.

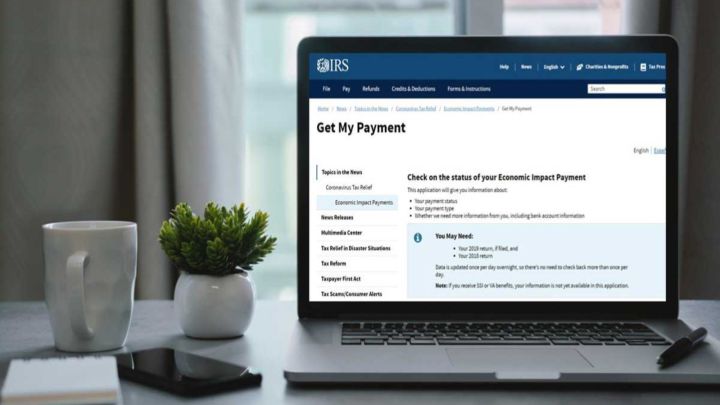

If you still do not receive the payment for the third stimulus check, the IRS has made the “ Get My Payment ” application generally available with which you can track the payment of your third check 24/7.

Get My Payment in Spanish: How to get my stimulus check and how to claim the IRS?

All you have to do to access the application is go to the official IRS site. There, you will find a section with the name ‘ Get My Payment ‘ where it will give you the option to download the application.

Once you have downloaded the application, the next step will be to provide your social security number, as well as your date of birth and address and zip code, thus, the application will allow you to track your check.

Through ‘ Get My Payment ‘ you can receive updates on the date your payment is scheduled to be deposited or sent by mail. You will also be able to know the payment method used by the IRS when issuing your check.

It is worth mentioning that the stimulus check will arrive automatically based on your most recent tax return, so you have nothing to do but wait for the IRS to send you the money. It is not necessary to submit any application to claim the payment.

Now, if you receive less money than you deserve, or you have not received the previous economic impact payments, you will have to claim the money that did not arrive through your next tax return.