President Biden on Monday signed an executive order to boost funding for the US biotech industry. The plan adds to President Joe Biden’s economic plan to bring back manufacturing jobs in the country.

According to official sources, the plan consists of promoting research in the field of biotechnology and being able to strengthen supply chains, avoiding future problems. There are clear examples such as jet fuel, a field where progress is being made in innovation to reduce polluting emissions and in which alternatives are being sought through biotechnology; or the agricultural sector, with the production of biological fertilizers. But it also covers the pharmaceutical field where active ingredients of medicines are being manufactured through biotechnology, which also allows “not to depend on foreign suppliers or hard-to-find mining elements. Who would have thought that we have gone from globalization to a deglobalization in stages?

Funds that invest in the biotechnology sector

Biotechnology is a megatrend oriented towards health, aging, economic growth, technological innovation and individualization. Its weight in GDP in advanced economies will increase in the coming decades. There are 7,000 drugs in development and two thirds of the new applications are of biotechnological origin.

Although the sector had an excellent performance in 2020 and later a certain stability in 2021, the first half of 2022 was marked by practically generalized falls. Along with health, he had a month of April to forget. Biotech stocks, especially small and mid-caps, continued to fall despite a positive long-term outlook, and it is that outlook that any investor thinking of entering the sector should prioritize. There will be times like the present, but in the long term it is a sector with permanence, growth and potential. We will see how, despite the above, there are investment funds whose annualized return at 3 and 5 years is still very juicy.

Recently there have been positive news flows into the sector, both as the Plan announced on Monday, but also an ongoing M&A process that makes for attractive opportunities that active managers are able to capture in their portfolios. In addition, there have been new drugs and regulatory approvals that are encouraging and have caused the sector to rebound from lows. Outflows from the sector have been declining, after reaching outflows of over a billion euros in May.

There is not a wide variety of funds, just a little more than a dozen, and although at 1 year the return is negative (-13.53%), at 3 years it exceeds 30%, which is equivalent to 9.84% annualized . Not bad right?

Among the outstanding funds in the sector are:

- Polar Capital Funds PLC – Biotechnology Fund, with a focus on small-cap stocks such as argenx (Holland immunology company), Genmab or Incyte. The volume of assets of this 4-star Morningstar fund exceeds 1,500 million dollars, which are invested in a portfolio of approximately 50 positions, such as those mentioned above. It is managed by David Pinniger, with extensive experience in the industry and consistent performance over time, which has led Citywire to give it an AAA rating, which is the highest rating given to managers. So far this year it has achieved a return of 5%, having recovered from the fall of 6.2% in the first quarter and -0.32% in the second. The annualized return at 3 and 5 years is in double digits (22.6% and 15.9% respectively), which means that it is consistently positioned among the first percentiles, if not to say, in the first position for profitability and second for maximum drop. The alpha at 3 years is 9.64% and it has a beta close to 1. More than 75% of the portfolio is invested in North American companies, while almost 24% in Europe (Denmark, France, United Kingdom, Germany, among others). In a recent interview, the manager commented that a tactical top-down perspective should prevail like the one they applied at the end of 2020, in the midst of the exuberance of the market, they greatly reduced risk, which in their own words “helped them preserve capital and generate a bit of profitability.

The biotech sector gets a boost from Biden

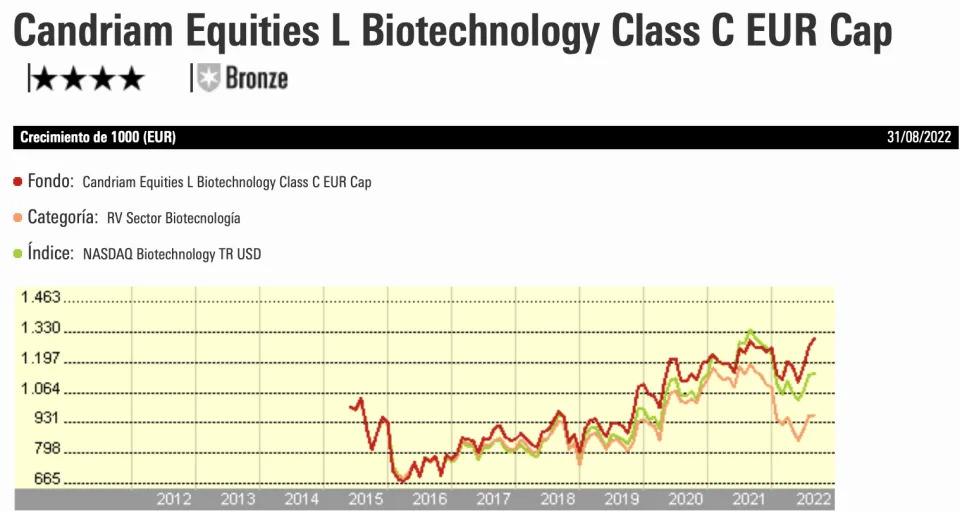

- One of our favorite funds is Candriam Biotechnology, one of those 4-star funds managed by a highly qualified team, led by Rudi Van den Eynde, who has demonstrated consistent management and extensive financial and strategic analysis. Its in-depth analysis and research in the oncology sector means that there is a high level of representation of this type of company in the fund, leading it to position itself in second position for profitability at 1 year, behind the previous one, but in a better position due to maximum drop. This is also maintained in the medium and long term. They also use a qualitative socrecard to complete this fundamental analysis, guaranteeing the coherence and discipline of their investment process. Unlike the Polar fund, the Candriam fund’s portfolio is less concentrated, generally made up of about 100 positions, thus avoiding high dependency on drugs in the preclinical or development phase, although with an active share of less than 50%. It shows a greater exposure to the United States (82.5%). The size of the fund is similar to the previous one, about 1,700 million dollars, with a growth style. Among the main positions in the portfolio are the American biotech company Regeneron Pharmaceuticals, which has risen more than 12% in the year; another American Gilead Science (-8.7% in the year); the Bostonian Vertex Pharmaceuticals with almost a 50% increase in the year; AztraZeneca, among others. The volatility of this fund is lower than that of the polar fund, but both offer an attractive profitability-risk binomial.

The biotech sector gets a boost from Biden