Friday’s upbeat U.S. jobs report prompted economists at JPMorgan Chase & Co., Evercore ISI and LH Meyer to say higher U.S. interest-rate hikes are now expected this year, while Citigroup Inc. estimates a risk of an increase of 1 percentage point in September.

JPMorgan’s Michael Feroli and LH Meyer’s Derek Tang now expect a 75 basis point hike at the Federal Reserve meeting on September 20-21, compared to previous estimates of 50 basis points. Meanwhile, analysts at Evercore led by Krishna Guha forecast an additional quarter percentage point this year, which would take the upper limit of the target rate to 3.75% for December.

US employers added 528,000 jobs last month, beating all estimates, the unemployment rate matching a five-decade low of 3.5% and wage growth accelerating, the Labor Department reported Friday. The data provides momentum for the Federal Open Market Committee (FOMC) to match the 75 basis point hike it announced in June and July as it works to cool an inflation rate that is at an all-time high. in 40 years.

“Inflation concerns driving the Fed will only be heightened by this jobs report,” Feroli wrote. The “figures should calm recession fears, but amplify concerns that the Fed has a lot more work to do, and we now think a 75 basis point hike in September is likely.”

Guha cited “recent strength in core inflation, wages and hiring, as well as recent easing in financial conditions, which we think the Fed will view as premature.”

Citigroup economists led by Andrew Hollenhorst wrote that the strong jobs report and rising wages “make a 75 basis point hike in September very likely and raise the potential for further large hikes.”

“Our base case remains a 75 basis point increase in September, but we would not be too surprised by a 100 basis point increase if stronger-than-expected core inflation is reported,” he wrote.

LH Meyer’s Tang said the firm now expects rate hikes to end at 4.25% instead of 4%.

Fed officials will also consider one more jobs data release and two readings of the consumer price index before their September meeting.

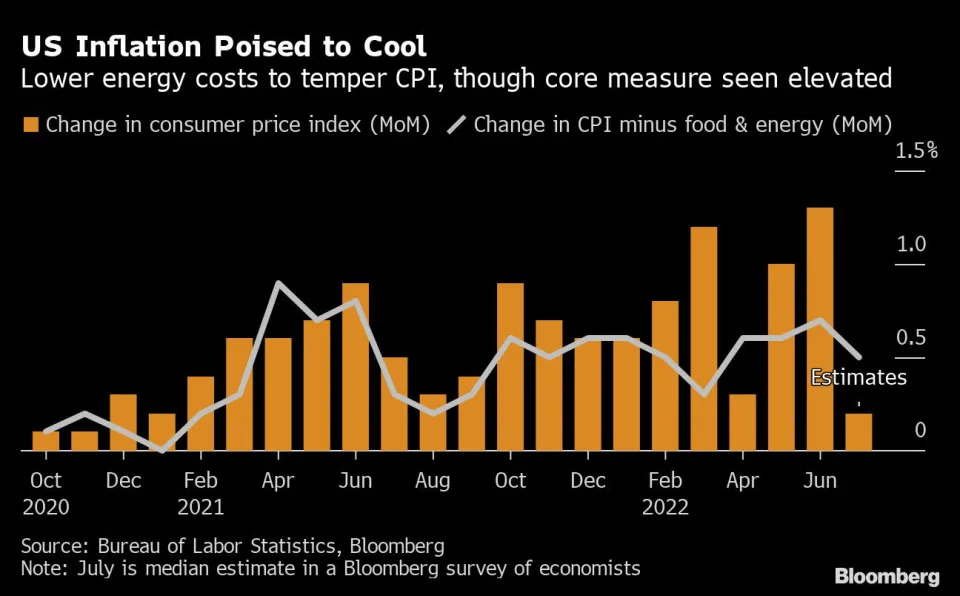

July data on consumer prices is released on Wednesday. Economists surveyed by Bloomberg expect the index to likely rise 0.2% from a month earlier, the smallest rise since January 2021. The so-called core reading, which excludes energy and food, likely rose 0.5%. , based on the median of the survey estimates.

In annual terms, price growth probably slowed to 8.7% from 9.1% the previous month, according to the median forecast.