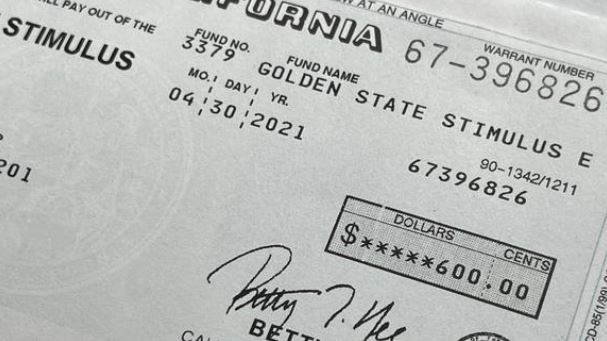

The stimulus check is being delivered in California and you could be one of the beneficiaries. Please review the subsidy details carefully.

Since last year, the sending of a batch of aid checks was announced to benefit millions of residents in order to resist the impact of rising prices and thus mitigate the impact of inflation and its scope, which is around than 23 million people in the United States. The amount to be received in California for each beneficiary varies between $200 and $1,050 dollars, they hope to know when they will be able to count on this money.

If you meet those requirements to be eligible, you should review what are the possibilities for undocumented immigrants to receive it and identify if you will receive the stimulus check through direct deposit or debit card.

Who will receive the stimulus check payment in California?

California will send out a new batch of relief checks ranging in amount from $200 to $1,050, which will benefit residents.

In addition, since October the one-time payments began to be issued as part of the Middle Class Tax Rebate (MCTR) and these will continue until January of this year depending on previous stimulus payments.

According to California state officials, about $8,399,171,700 has been refunded since last week.

Requirements to apply to the Stimulus Check

The MCTR website notes that those eligible for payments include taxpayers who:

- Have filed the 2020 tax return before October 15, 2021.

- Those who meet the California Adjusted Gross Income (CA AGI) limits.

- Who have not been chosen to be claimed as dependents in tax year 2020.

- They must be California residents for six months or more of the 2020 tax year.

- Who are California residents on the date the payment is issued.

How to receive the California 2023 Stimulus Check payment?

It should be noted that beneficiaries will receive their payment via direct deposit or debit card.

Californians who electronically filed their 2020 tax return and received their refund via direct deposit will receive their payment the same way.

The California Franchise Tax Board stated that other payees will receive payment by mail in the form of a debit card if:

- They filed a paper statement

- Had a balance due

- They received their Golden State Stimulus (GSS) payment by check

- Received their tax refund by check regardless of filing method

- They received their 2020 tax refund via direct deposit, but their banking institution or bank account number has since changed

- Received an advance payment from your tax service provider or paid your tax preparer’s fees using your tax refund

When will I receive my 2023 Stimulus Check payment?

You should note that direct deposits generally occur within three to five business days from the date of issuance, but may vary by financial institution.

With this in mind, recipients should wait up to two weeks from the issue date to receive their debit card in the mail.

According to The U.S. Sun, MCTR debit card payments for Californians who received Golden State Stimulus (GSS) I and II were mailed from late October through December 10, 2022.

Meanwhile, recipients of GSS I or II checks with a last name beginning with W through Z should have received their debit cards between December 4 and December 10.

Non-GSS recipients with last names beginning with A through K received their payments on or after December 5 and December 17.

MCTR direct deposit recipients who have changed their banking information since filing their 2020 tax return will receive theirs between December 17, 2022 and January 14, 2023.

Finally, the remaining debit cards will be mailed by January 14.

Can I track the shipment of my payment?

This is one of the questions that the beneficiaries ask themselves the most, that is, if there is any tool to track their check and, above all, to know when they will be able to access it. However, this option does not exist, so there is no other option than to be patient, waiting for the moment in which the deposit is reflected in their accounts or the arrival of the debit cards.