Main figures compared to the Bloomberg consensus:

- Unit sales reach 487,000 million (-9.6%)

- Revenues 34,858 million euros (+6%) vs. 33,550 million euros estimated

- EBIT 5,229 million euros (+11.2%) vs. 4,766 million euros estimated

- BNA 3,490 million euros (-18.6%) vs. 3,297 million euros estimated

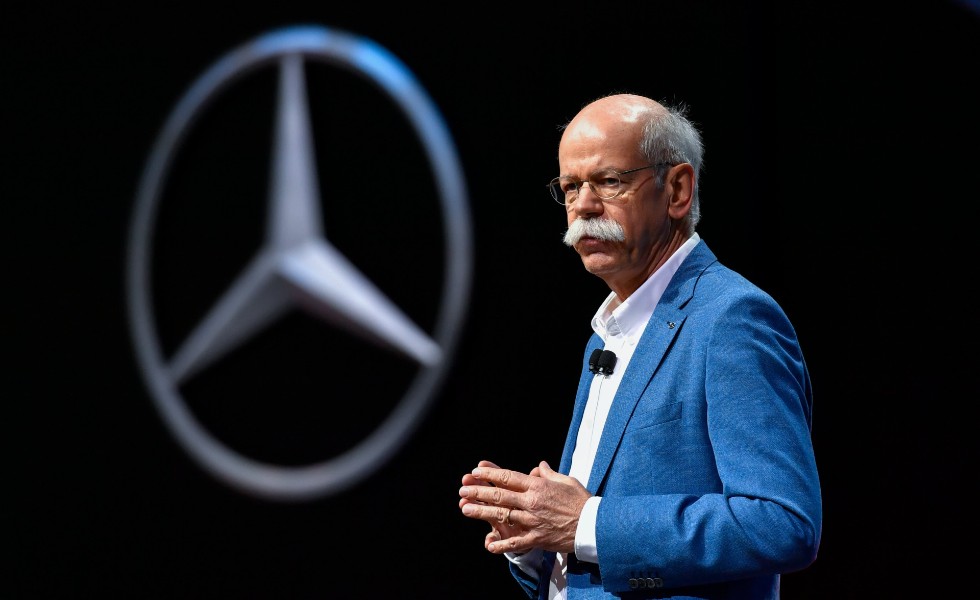

Opinion on the results of Daimler

Figures that exceed consensus estimates . One more quarter confirms the Company’s pricing capacity . Vehicle sales fall close to -10% in the quarter penalized by the shortage of semiconductors, the new restrictions due to the outbreak of the virus and the war between Russia and Ukraine. However , revenues advance +6% and EBIT +11%. Production remains focused on premium models while the cost-cutting policy continues. With this, the EBIT margin of the car segment advances to 16.4% vs. 15.8% former .

The balance also continues to offer good news. The net cash position of the industrial business has advanced +8% since the end of 2021 (up to 22,706 million euros). In the future, the Company warns of a very high degree of uncertainty due to the war in Russia/Ukraine, the bottlenecks and the rise in the cost of raw materials and energy. Despite this, it confirms the guidance for the year as a whole . He estimates an EBIT for the car division of between 11.5%/13%, probably close to the upper threshold of the range. In short, good figures that should boost the share price today .

Daimler Recommendation

Neutral Recommendation with a Target Price of 73.3 euros.