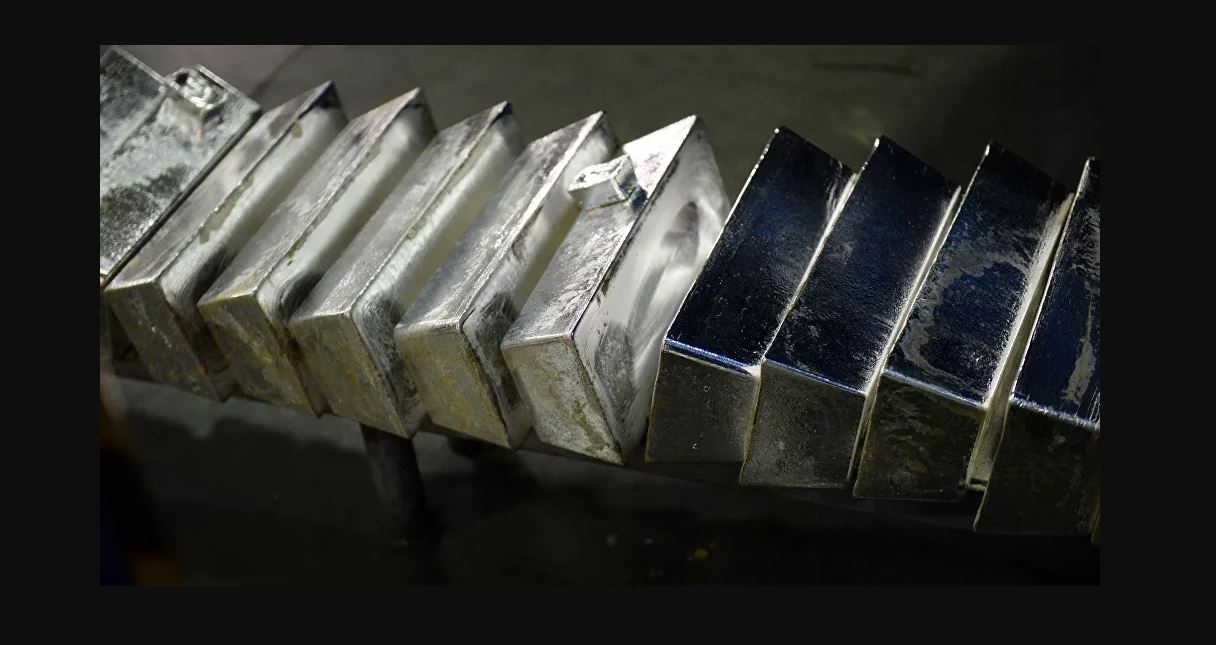

After having heated the price of shares of the video game chain GameStop, the Reddit Gang forged a new plan: to raise the price of silver. The reaction of the metal was not long in coming. Will they be able to throw a party like GameStop?

The silver market is “one of the most manipulated in the world,” said a Reddit user who called on others to participate in a GameStop– like flash mob . According to the Internet user, any pressure on financial tools supported by this precious metal would be “something epic.”

“We know that billions of banks are manipulating gold and silver to cover real inflation. Think of profits. If you don’t care about them, think of banks, like JP Morgan, that you would be destroying along the way,” he wrote, calling to increase the price of silver from $ 25 to $ 1,000 per ounce.

A failed party

Although he assured that he is not a professional expert in financial services, his publication has managed to affect the prices of the metal. As a result, between January 28 and 29, its price shot up almost 10% from its low of $ 25.01 per ounce to $ 27.45.

Analysts at the British agency warned that this rally would not last long, as the size of the respective market makes it much less easy to influence than companies like GameStop. So the promotion of the shares of the video game chain carried out by Reddit peeps led, among other causes, to its price growing more than 2,250% .

“We are confident that the influence of retail investors in silver will not last as long, and that ultimately industrial and institutional demand will be the key factor in the long term,” emphasized Commerzbank analyst Eugen Weinberg.

This forecast has not been long in coming true. On January 29, silver prices fell to 2.4% from its daily maximum to stand at $ 26.77 per ounce, although it later recovered part of its value.

The rise in the price of silver helped to increase that of gold. It rose 1.5%: from $ 1,842.74 per ounce recorded in the first hours of January 29 to reach its daily maximum of $ 1,871.98 per ounce. In fact, during the first month of 2021 the yellow metal has not been up to par. Between January 5 and 17, it lost more than 7% of its value, and marked the worst performance for January in the last decade .

The dynamics of gold prices contrasted with those of the dollar and Treasury Department bonds, while investors were weighing the prospects for economic recovery after the pandemic.

Before being pushed by silver, the ounce of gold suffered another fall after on February 28 the Federal Reserve announced that it would leave the interest rate of 0.25% unchanged. This news strengthened the dollar.

In addition, the US central bank promised to continue buying bonds for a total value of 120,000 million dollars a month until substantial progress was made in solving problems related to the recovery of employment and the reduction of inflation.