All immigrants, with or without a social security number, must file a tax return, and to do so they need special identification.

It is Individual tax identification numberknown as ITIN, for its acronym in English.

If the person is not entitled to a social security number, it is important that they obtain this identification.

Why is the ITIN important?

Anyone, even undocumented, who works in the United States must file a tax return, even if they do not have a Social Security number.

For undocumented people, tax experts advise that paying taxes is important if you plan to apply for a work permit or permanent residency.

However, you should be aware that if you file your taxes with an ITIN number, you are not eligible for certain federal credits, such as the Earned Income Credit.

But you may qualify for other tax credits.

Children without a social security number can also obtain an ITIN number.

How can I get the ITIN?

This identification number must be requested from the IRS. The process can be done when you prepare your tax return.

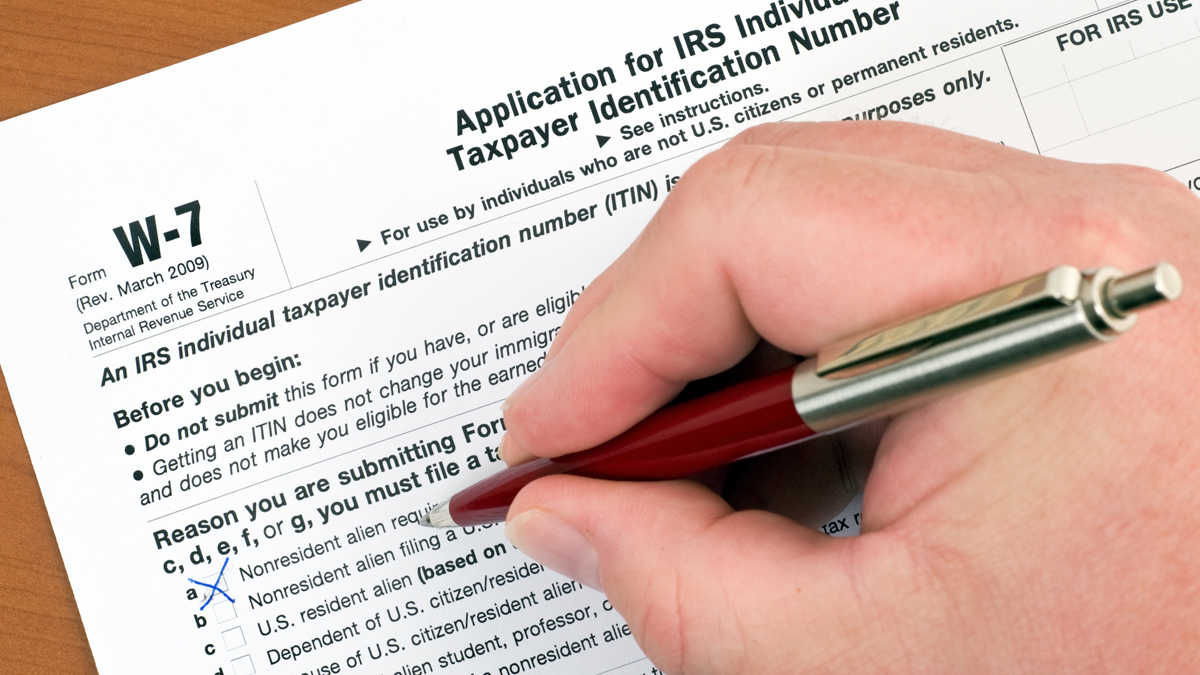

To do this, you must use the Form W7, to which you must attach copies of your identity documents. If you use a passport, it must be up to date.

Freelancers need to take extra steps to avoid making costly mistakes. Azalez Iñiguez explains how to prepare your taxes without having problems with the IRS.

The W7 form and the ITIN application are free

If the person plans to request the ITIN number when filing their taxes, it is recommended not to wait for the deadline, which this year is April 18.

“If people come in February or March and want to apply for an ITIN, they have to file an extension and wait seven or even ten weeks during the tax process to receive one,” explains Vilma Ríos. of the National Association of Tax Preparers.

What credits can be received with an ITIN?

If the taxpayer has children, they are eligible for the head of family credit. Also for what is called college credit and child care credit.

To find out where to get free tax assistance, Click here.