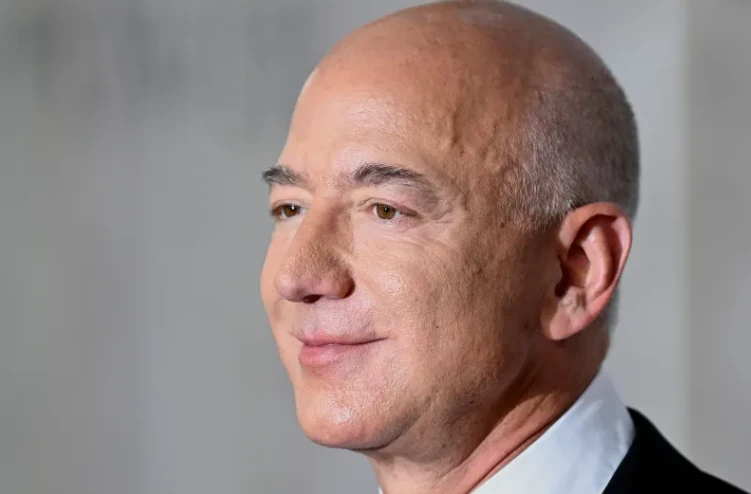

Despite what many of us might imagine, Jeff Bezos, executive chairman of Amazon, wants Americans to save more, consume less, and know what to do with their money in times of recession.

When any of us hears that Jeff Bezos, Amazon’s founder, gives investment advice, we might fall for the mistake that it’s a direct invitation to invest in his company. The tycoon is of a bigger thought than that. And with forecasts that we are approaching an economic slowdown in the country (and the world), Bezos prefers that Americans spend their money better by investing between recession-proof sectors.

During an interview with CNN, Bezos commented that the economy “doesn’t look good right now,” especially given the signs of slowdown that many companies have shown in recent months.

“Things are slowing down,” Bezos said in the talk. “You are seeing layoffs in many, many sectors of the economy.”

Big companies like Meta, Alphabet, Microsoft and even Amazon have announced thousands of layoffs. But the billionaire points out that the current situation not only affects technology companies, but other productive areas of the country.

Such is the concern generated by this situation, that even Bezos recommended not using the money for occasional purchases, even if that means that consumers move away from his online store, and better keep it in his pocket.

“If you’re an individual considering buying a big-screen TV, you may want to wait, save your money, and see what happens,” Bezos recommends. “The same goes for a new car, a refrigerator, or anything else. Just take some risk out of the equation.”

But if you want to make it work through an investment, there are three productive sectors, other than Amazon, that are recession-proof:

1. Public services

Investing in companies may seem like a risk during a recession, however, there are industries that will always get busy, like it or not, and that require money to push them forward. The economy may slow down, but homes will always require water, home heating and electricity. Public services are infallible in times of recession.

2. Health care

Another sector that cannot stop even with a recession is health care. The sector offers a lot of growth potential in the long term, especially due to life changes, such as population aging and growth.

3. Real estate

Although it seems that real estate is not the best area to invest in during a slowdown, people should remember that when it comes to investing, a setback is an opportunity.

It is true that current mortgage rates do not make the market favorable, however, a reversal in prices is expected that could benefit buyers in the long term.

“Between 1978 and 2021, there were 10 separate years in which the federal funds rate increased,” says Invesco, an investment management company. “Within these identified 10 years, US private real estate outperformed stocks and bonds seven times and US public real estate outperformed it six times.”

It is not necessary to be an owner to invest in real estate, you can also do it through real estate investment trusts (REITs).