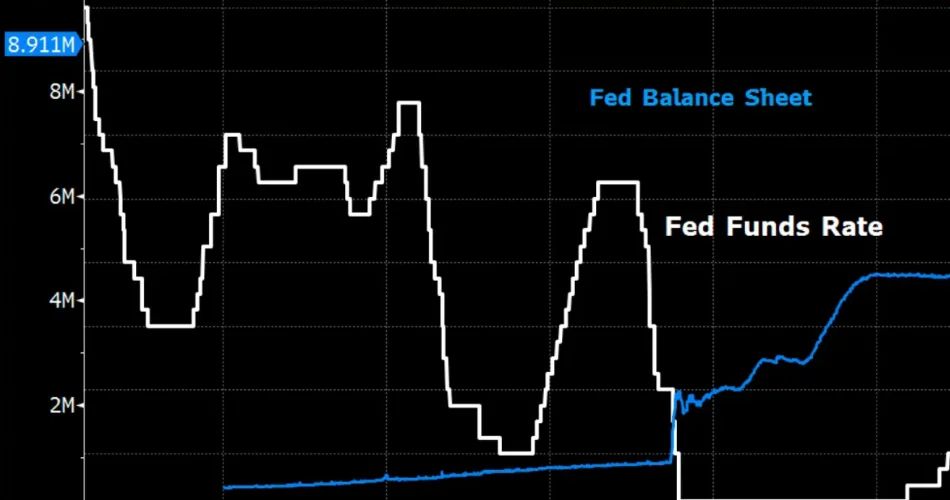

The Federal Reserve is poised to make a significant move in September 2024 by cutting interest rates. This long-awaited decision could impact your finances. Here’s what you need to know:

- Why the Cut?

- The Fed aims to stimulate economic growth and manage inflation. A rate cut can encourage borrowing, spending, and investment.

- Keep an eye on your savings accounts, CDs, and mortgage rates—they may be affected.

- Should You Open a CD?

- With lower interest rates, Certificates of Deposit (CDs) may offer less attractive returns.

- Consider other investment options or consult a financial advisor.

- Debate Dispute: Trump vs. Harris

- Kamala Harris and Donald Trump are gearing up for their upcoming debate.

- Trump prefers live mics, but his team wants them off when it’s not his turn to speak.

- Tulsi Gabbard Endorses Trump

- Former Democratic candidate Tulsi Gabbard endorsed Trump in Detroit.

- She joined him at Arlington National Cemetery to mark the Afghanistan airport bombing’s third anniversary.

- Harris supports Biden’s Afghanistan withdrawal, a decision Trump opposes.

- Donor Enthusiasm for Harris

- Kamala Harris’ surprise candidacy has led to a surge in donations.

- Her campaign raised over $310 million in July, outpacing Trump’s fundraising efforts.

- Stay Informed

- Follow the unpredictable 2024 presidential race closely.

- Explore the candidates’ key policy issues and make an informed choice.

Remember, these developments could impact your financial decisions and voting choices. Stay informed and be prepared!