The WSB Reddit peeps who challenged Wall Street with the purchase of shares in GameStop, a company dedicated to the sale of video games that increased its performance on the stock market by 1,500%, they have changed their objective and, through a series of videos on YouTube, they have coordinated to invest in the silver market.

In fact, since the first massive investments in the sector began on Friday, the price has already risen 13% in the futures market and 10% in cash. The iShares Silver Trust received $ 1 billion from multiple locations around the world last Friday. The world stock markets have already noticed this increase in investments. For example, China Silver Group has grown 45% in Hong Kong and Silver Mines 49% in Australia.

Faced with the fear of a situation similar to that of GameStop, there are brands, such as Money Metals, which have restricted silver trading, as reported by the Reuters agency.

How do WSB Reddit peeps work?

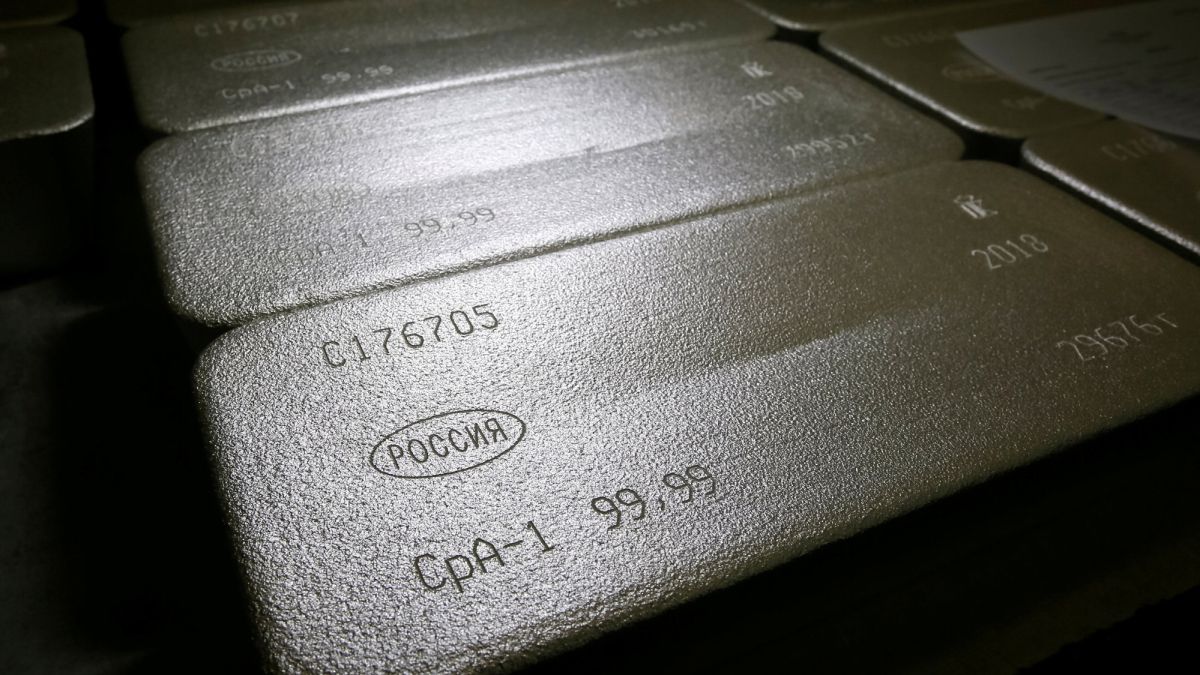

Buyers invest large sums of money in the sector, forcing silver to be bought physically. Silver is not a particularly abundant metal, so since there is so much demand, the price grows. Thus, Bearish investors, that is, those who earn more money the more the price of the product in question falls, are the most affected.

This is what happened to Melvin capital with GameStop. The company had to sell percentages of its company in exchange for 3326 million dollars that allowed it to refloat in order to maintain its economic activity.

Can there be as big impact as GameStop?

Specialists believe that the impact will not be as great as that of the video game company because the market volume of silver is infinitely higher than GameStop.

In addition, there are other reasons that analysts add to defend the difficulty of a bigger hit with the investment in silver. The first is that the value of physical silver held on the London Stock Exchange is valued at 54426 million dollars, while GameStop in January was almost 35 times lower. The second is that Most of the transactions carried out with the metal take place in a bilateral market that investors organized by forums or social networks cannot enter.